When Cindy and I lived in Australia, among the many things we missed about living in the USA was the ubiquity of Amazon and its books. Want a book tomorrow? Easy peasy. Just order it from Amazon and tomorrow morning it’s at your doorstep. Not so in Oz, where Amazon shipments had to begin in America and slowly make their way across the Pacific. Indeed, that trip made things simply too expensive and we demurred. But now Amazon is moving to the land down under. Watch out Oz! Amazon is coming!

(from the Wall Street Journal)

By Mike Cherney in Sydney and Laura Stevens in San Francisco, May 17, 2017 5:30 a.m. ET

Amazon.com Inc. is preparing to bring its full retail offering to Australia, signaling a major competitive threat to the country’s retailers and an important new beachhead for its global distribution network. Australia’s more favorable regulatory climate is also likely to offer Amazon opportunities to test deliveries via autonomous drones and road vehicles, a person familiar with the matter said. Australia last year rolled out new rules for remote-operated drones, and government officials are looking to develop national guidelines for autonomous-vehicle trials.

Amazon, which announced its Australia intentions last month, hasn’t said when the full retail offering will roll out. Some analysts say 2018 is a likely date.

Australians can already order products from Amazon overseas, but they typically pay higher prices for shipping and wait longer for delivery than Amazon shoppers in other countries with domestic operations. This has constrained Amazon’s challenge to online competitors such as eBay Inc. in Australia, as well as traditional retailers, which have until now been somewhat insulated from the demise of brick-and-mortar stores rippling across the U.S.

That could soon change. One analysis from Citigroup Inc. found that Amazon sales could grow from between 500 million Australian dollars ($371.3 million) and A$700 million currently to A$4 billion in the medium term, a significant chunk of the roughly A$20 billion Australian e-commerce market. Electronics retailers are expected to be the hardest hit, with Citi lowering its long-term earnings-per-share forecasts for some Australian companies by more than 30%.

Australian retailers haven’t until now faced the kind of competition that would have forced them to invest heavily in their online offerings, says Citi retail analyst Bryan Raymond. Retailers in other countries have “been forced into it through Amazon or someone else pushing people that way.”

The Australian e-commerce market is small compared with the U.S., where online sales last year were estimated at $391 billion according to the U.S. Census Bureau, but the lack of a truly dominant online retailer suggests there is an opportunity for Amazon. One measure from Citi gives Amazon 4% market share in Australia. In the U.S., Amazon’s share is 31%, Citi says.

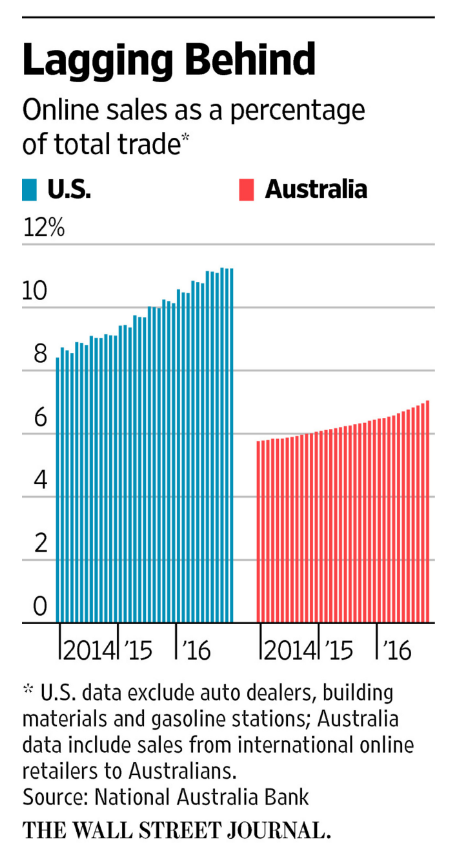

Australian e-commerce numbers are behind other developed countries (see chart), so there could be room for growth, making Australia an attractive market for Amazon as it seeks to expand its international footprint. The company is spending billions of dollars to secure growth in Mexico and India, and recently reupped its attempt to take on Alibaba Group Holding in China as it diversifies away from relatively saturated U.S. and European markets.

Australian e-commerce numbers are behind other developed countries (see chart), so there could be room for growth, making Australia an attractive market for Amazon as it seeks to expand its international footprint. The company is spending billions of dollars to secure growth in Mexico and India, and recently reupped its attempt to take on Alibaba Group Holding in China as it diversifies away from relatively saturated U.S. and European markets.

The Chinese market has proved tough to conquer. Amazon launched its Prime membership program there late last year aiming to capitalize on Chinese consumers’ desire for products from overseas, but it has been fighting to gain share against entrenched local incumbents. India has been more of a success story, where Amazon is one of two market leaders. Still, it is facing increased competition there too after No. 1 Flipkart Group’s recent $1.4 billion fundraising round.

Amazon has cited its rapid international growth as a reason for higher spending in recent quarters. The company takes varying approaches by market when it expands internationally and balances growth carefully with management bandwidth, said Chief Financial Officer Brian Olsavsky on a recent earnings call.

“We pick our spots carefully,” he added.

In Australia, online sales were about 7% of total retail in 2016, compared with 11% in the U.S., 15% in the U.K., and 18% in South Korea, according to Euromonitor International. Canada, a country that is similarly vast and with a relatively low population like Australia, is also at 7%.

Australia could also fit into Amazon’s plan for a global transportation network that the company envisions will eventually compete with global logistics companies like United Parcel Service Inc. and FedEx Corp. according to people familiar with the matter. It has said it is leasing 40 planes and purchasing thousands of branded truck trailers, as well as building its first dedicated air cargo hub in Kentucky.

Amazon has also formed a team to look at the future of autonomous vehicles, and it has already completed its first commercial delivery via drone in the U.K.

Drone experts say regulations are similar in both Australia and the U.S., but there are some signs Australia might have an edge, perhaps further enticing Amazon into the Australian market. “Australia is clearly committed to testing drone delivery,” said Ben Marcus, chief executive of drone airspace services technology provider Airmap. There is a strong case to use drones for rural deliveries there, he said.

The country is nearly the size of the contiguous U.S. but has less than 10% of the people.

Jodie Burger, a lawyer with an aviation specialty at Corrs Chambers Westgarth in Brisbane, Australia, said she wouldn’t be surprised if Amazon began testing drone deliveries in Australia soon. “It’s ripe for the picking,” she said. “I don’t think it will be very long at all.”

Amazon declined to comment on possible drone or autonomous-vehicle tests in Australia. As it builds out its network in Australia, Amazon will likely rely on its logistics network in the U.S. as a model—where big warehouses called fulfillment centers are strategically located near population centers. Amazon has said it is already looking for a fulfillment center location in Australia, with analysts saying Sydney is a likely starting point.

Amazon’s Prime membership program in the U.S. offers two-day delivery, with same-day delivery available in some areas. Although Australia’s vast size and rural areas could bring challenges, Amazon will likely first focus on the east, experts say, where the country’s three biggest metro areas, centered on Sydney, Melbourne and Brisbane, are located. About half of all Australians live in those metro areas.

“I would imagine they would start off in one or two warehouse facilities in the east coast,” said Nathan Huppatz, co-founder of Costumes.com.au and shipping software service ReadyToShip.com.au. “It’s quite possible they can make that two-day promise to most of the capital cities very early on.”